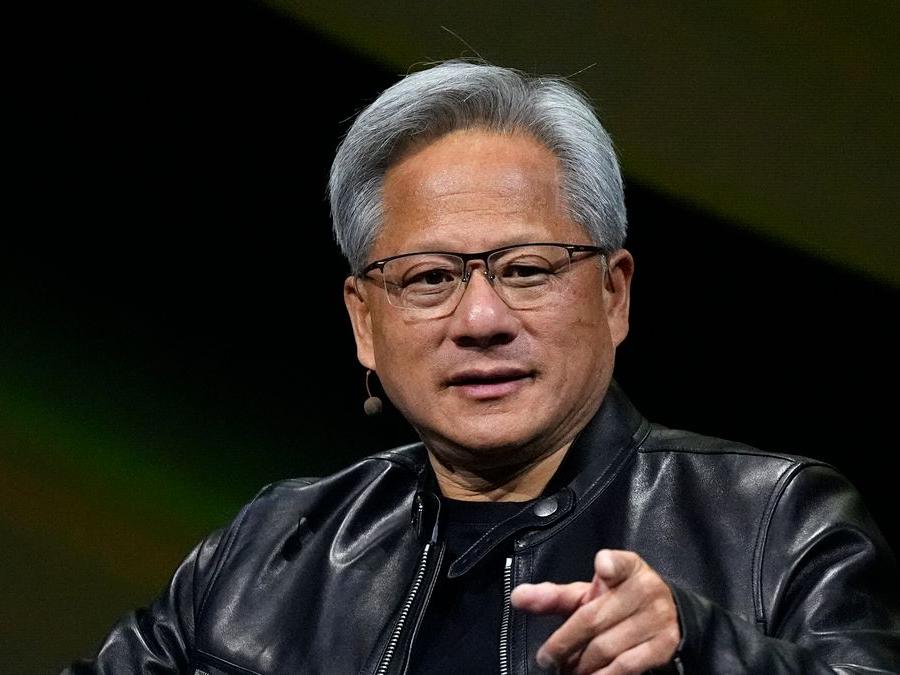

Nvidia, the leading AI chip manufacturer, reported stellar Q2 2024 earnings on August 28, 2024, with revenue soaring 122% year-over-year to $30.04 billion, significantly surpassing analyst expectations of $28.7 billion. The company’s data center business, fueled by surging demand for AI chips, saw an impressive 154% increase in revenue to $26.3 billion. Nvidia’s net income for the quarter reached $16.6 billion, marking a 168% increase from the previous year.Despite these record-breaking results, Nvidia’s stock price fell by approximately 4-7% in after-hours trading. This decline was primarily attributed to the company’s Q3 revenue forecast of $32.5 billion, which, while above the analyst consensus of $31.77 billion, fell short of some investors’ more ambitious expectations. CEO Jensen Huang remained optimistic, stating, ‘The demand for the Hopper chip is still strong and the expectation for Blackwell is incredible’.Investors’ concerns also centered around potential production challenges with Nvidia’s next-generation Blackwell chips. However, the company addressed these worries, with Huang announcing, ‘The Blackwell samples are being shipped to our partners and customers,’ and projecting ‘several billion dollars in revenue from Blackwell chips in the fourth quarter’.The market’s reaction highlights the high expectations placed on Nvidia, with its stock price having risen over 150% year-to-date. As analyst Stacy Rasgon noted, ‘The results didn’t surpass expectations as dramatically as in previous quarters’. This situation underscores the challenges Nvidia faces in maintaining its explosive growth trajectory and living up to its lofty valuation.In a move to boost investor confidence, Nvidia announced a new $50 billion share buyback program. The company also reported a gross margin of 75.1% for Q2, slightly below analyst expectations of 75.5%.Nvidia’s earnings report has become a key indicator of the AI industry’s health and the broader tech sector’s performance. As Jensen Huang emphasized, ‘AI generative is going to revolutionize every sector’. However, the market’s reaction suggests that investors are becoming more cautious about the sustainability of the AI-driven boom and are closely scrutinizing any signs of potential slowdown in this rapidly evolving landscape.

Key points

- Nvidia’s Q2 2024 revenue soared 122% to $30.

- Despite strong earnings, Nvidia’s stock fell 4-7% due to concerns about future growth and production challenges.

- Nvidia announced a new $50 billion share buyback program to boost investor confidence.

- The company expects significant revenue from its next-generation Blackwell chips in Q4 2024.

04 billion, beating analyst expectations.

Contradictions👾While Nvidia reported record earnings, the stock price fell, indicating a disconnect between financial performance and investor expectations.

👾Nvidia’s CEO expressed confidence in Blackwell chip demand, but investors showed concern about potential production challenges.