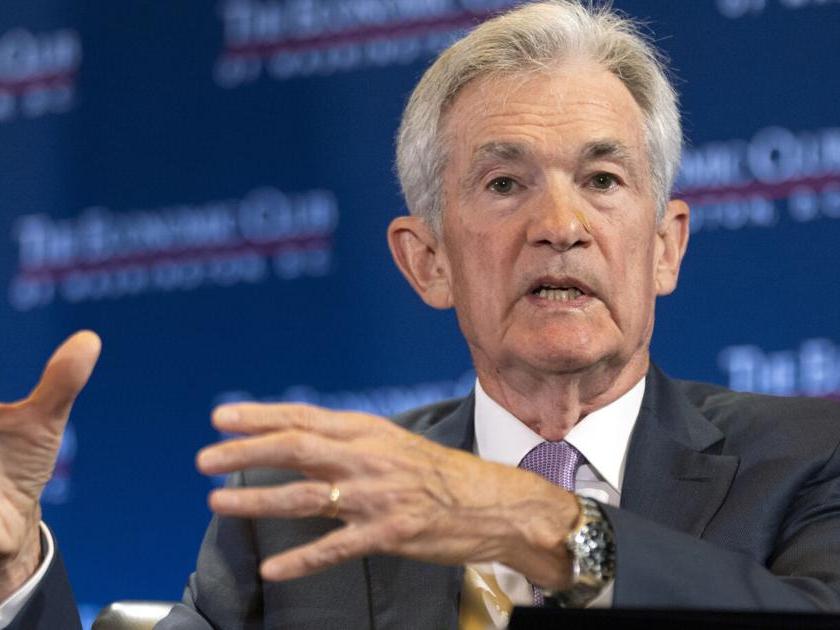

Federal Reserve Chairman Jerome Powell’s speech at the Jackson Hole Economic Symposium on August 23, 2024, has signaled a pivotal shift in U.S. monetary policy, declaring that ‘the time has come to adjust policy’. This statement has been widely interpreted as paving the way for interest rate cuts, potentially beginning as soon as September.Powell’s remarks were grounded in the Fed’s assessment of current economic conditions. He expressed increased confidence that inflation is on a sustainable path back to the 2% target, noting that it has fallen significantly from its peak. The Fed’s preferred inflation measure now stands at 2.5%, down from 7.1% two years ago.Alongside inflation concerns, Powell highlighted changes in the labor market dynamics. ‘The labor market has cooled significantly from its overheated state,’ Powell stated. He emphasized that the Fed does not seek further cooling in labor market conditions, signaling a shift in focus towards maintaining employment levels.While Powell did not commit to specific timing or magnitude of rate cuts, market expectations have shifted dramatically. Many economists expect a modest quarter-point cut in the benchmark rate in mid-September. However, some analysts are now considering the possibility of a larger half-point cut, with the CME FedWatch tool showing a 60% chance of a quarter-point cut and a 40% chance of a half-point cut.The financial markets responded positively to Powell’s speech, with stock indices rising and Treasury yields falling. The Dow Jones Industrial Average closed above 41,000 for the first time since July, rising by 462 points or 1.1%.Powell stressed that future monetary policy decisions will remain data-dependent, stating, ‘The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks’. This approach leaves room for flexibility as the Fed navigates the complex task of achieving a ‘soft landing’ – bringing inflation down to the 2% target while maintaining a strong labor market.The Fed’s next meeting is scheduled for September 17-18, and investors are closely watching for potential rate cuts. However, some economists and politicians have expressed concerns about the timing of rate cuts ahead of the presidential election on November 5.Despite the positive market reaction, experts warn of potential volatility in the coming months as the Fed navigates this new phase of monetary policy. The shift in U.S. monetary policy could also influence other central banks, with the European Central Bank having already cut rates in June and considering further reductions.

Key points

- Federal Reserve Chairman Jerome Powell signaled readiness for interest rate cuts, citing progress on inflation and labor market cooling.

- Markets are now considering the possibility of a larger half-point rate cut in September, alongside the previously expected quarter-point cut.

- Powell’s speech triggered a positive market reaction, with major stock indices rising and Treasury yields falling.

- The Fed’s next meeting in September, just before the presidential election, has raised some political concerns about the timing of rate cuts.

Contradictions👾While most sources indicate expectations for a quarter-point rate cut in September, some reports suggest increased market expectations for a larger half-point cut, showing some disagreement on the magnitude of the expected rate cut.