Volkswagen has made a bold move in the electric vehicle (EV) market by announcing a $5 billion investment in US-based EV maker Rivian. This strategic partnership is set to create a joint venture that will share EV architecture and software, propelling Rivian’s stock price up by an estimated 50% in extended trading. The collaboration is expected to boost Rivian’s growth in Europe and Asia while providing Volkswagen with access to advanced software architecture and accelerating the development of new, more affordable EV models. Analysts view this investment as a significant win for Volkswagen, which has faced challenges with its EV software development. The deal also instills investor confidence in Rivian, which has been grappling with financial losses per vehicle delivered but has managed to avoid bankruptcy. Meanwhile, global stock indexes rose, with Nvidia’s shares climbing over 5%, contributing to gains in the Nasdaq and S&P 500’s technology sectors. The dollar strengthened against the Japanese yen, and investors are now anticipating the release of the personal consumption expenditures price index and the outcome of snap elections in France. As markets adjust to this news, Volkswagen’s shares have experienced fluctuations, initially rising but then falling, reflecting the market’s mixed reactions to the investment and its implications for Volkswagen’s financial strategy.

Key points

- Volkswagen announces a $5 billion investment in Rivian, aiming to share EV technology and software.

- Rivian’s stock price is expected to surge by about 50% following the investment announcement.

- The partnership is anticipated to strengthen Rivian’s global presence and bolster Volkswagen’s EV software capabilities.

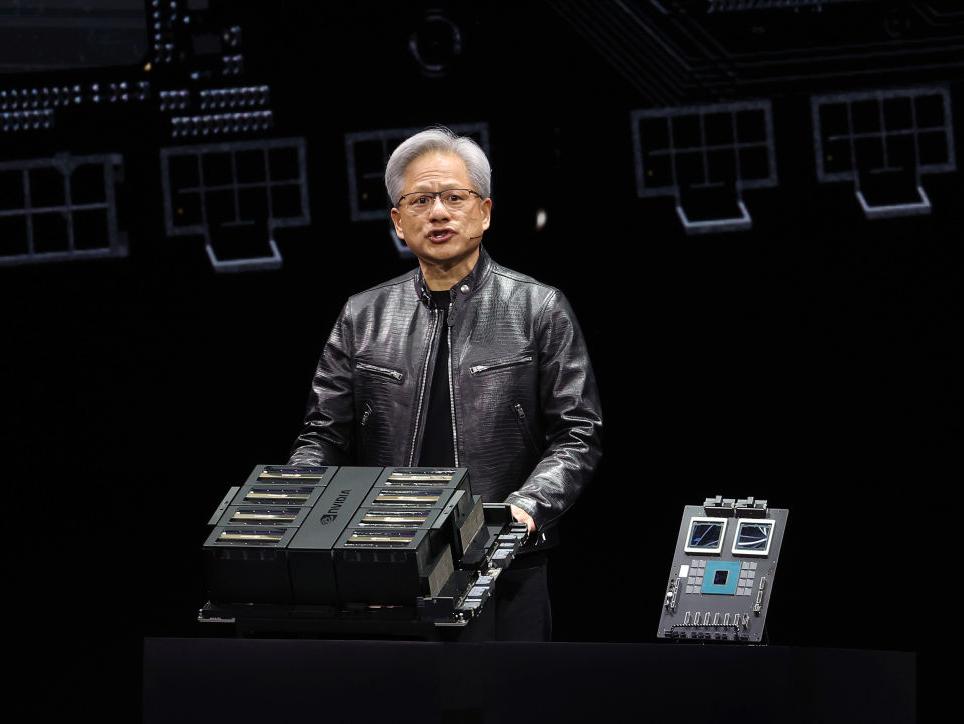

- Global stock indexes rise, with Nvidia’s stock recovery positively impacting the Nasdaq and S&P 500.

Contradictions👾While Rivian’s stock is expected to surge due to the Volkswagen investment, Volkswagen’s own shares have shown volatility, initially rising but then falling after the announcement.